Each June, Black Americans commemorate the emancipation of enslaved people on Juneteenth. On the 19th of June in 1865, federal troops arrived in Galveston, Texas to free the last slaves, two and a half years after the Emancipation Proclamation was signed. This holiday holds deep significance for Black Americans as a celebration of liberation. In the years following emancipation, the so-called “owners” of captive slaves were compensated for their loss. Meanwhile, those whose forced labor built the wealth of this nation were never repaid and were, in fact, systemically harmed by those who profited in the wake of emancipation. The effects of this failure to redistribute wealth are felt to this day and have contributed greatly to current racial inequities. It’s time for those who profited from the suffering of black people to pay reparations, including Wells Fargo.

While Wells Fargo was founded in 1852, it acquired Wachovia in 2008, thus intertwining itself with a very dark history. Wachovia was founded in 1879, descended from the Georgia Railroad and Banking Company, the Bank of Charleston and Atlanta’s Fourth National Bank. All of these companies had deep ties to the mistreatment of black people. As part of their banking practices, the Georgia Railroad and Banking Company accepted slaves as collateral on mortaged properties or loans. They owned at least 162 slaves during their time. The Bank of Charleston had similar practices, accepting minimum 529 slaves as collateral for loans and mortagaged properties. When slaveowners defaulted on their payments, the Bank would seize ownership of some slaves.

Atlanta’s Fourth National Bank was founded by former Mayor of Atlanta, James English, through the profits he generated from his company, the Chattahoochee Brick Company. By 1897, English leased at least 1,206 Black convicts in Georgia to labor for his businesses, including the Chattahoochee Brick Company. The conditions were abysmal, with historian Douglas Blackmon describing the company as a “death camp” for the majority Black convicts. When Wells Fargo acquired Wachovia, it made no apology for how Wachovia generated its wealth, in part, through slavery or convict labor. The past of Wachovia and Wells Fargo inform their present day practices, which build on this history of discrimination and harm through modern channels.

A federal investigation found that from 2004 to 2009, Wells Fargo harmed Black and Hispanic communities through engaging in discriminatory lending practices against 30,000 Black and Hispanic borrowers. This ultimately resulted in Wells Fargo paying over $175 million in a 2011 settlement with the United States Justice Department. But the same year of their discrimination settlement, Wells Fargo became the second largest investor in GEO Group, a leading private prison corporation, with 4.3 million shares in the company. Just one year later, Wells Fargo was named as the issuing lender on a $785 million line of credit for CCA, another leading private prison corporation presently known as Core Civic, and was also named as the trustee for a $300 million GEO Group bond. Not only did Wells Fargo learn nothing from its discriminatory lending lawsuit, it proceeded to bankroll the two leading corporations perpetuating modern-day enslavement of Black Americans through the private prison system. The chart featured in a report by In the Public Interest outlines the history between these private prison operators and Wells Fargo in more detail.

What’s the significance of this? Core Civic and GEO Group are corporations which profit from and perpetuate the imprisonment and modern day enslavement of Black Americans. In 2019, Wells Fargo succumbed to the mounting public pressure of prison divestment campaigns by stating it was exiting the credit agreement with Core Civic and phasing out of its partnership with GEO Group. This was a significant win for the organizers involved with these campaigns. But as of December 2021, Wells Fargo still held over a hundred thousand shares total in these private prison companies.

In the same realm, Wells Fargo has a history of being among the top sponsors, funders and board members for police foundations of multiple major cities, including sponsoring police foundations in Charlotte, Sacramento, and Seattle, Atlanta and Charlotte. Police foundations are private organizations dedicated to raising money for police departments as well as supplying them with weaponry and surveillance technology. Their private status enables these foundations to add millions of dollars to police budgets with very little public oversight or approval. Police foundations have been known to supply departments with K-9s and police horses, both used as a means to harm black people and protestors. The surveillance technology these foundations provide to police departments are highly controversial and disproportionately “tested and targeted in Black, Brown and Indigneous communities”. In response to the calls to defund the police that arose in the general public during Summer 2020, the police foundations for NYC, Washington D.C, Seattle and Philadelphia removed information on their websites regarding partner organizations and board members. A shameful act intended to limit the public’s knowledge and to protect donating corporations, like Wells Fargo, from public outrage. In this year of 2022, a senior leader from Wells Fargo is listed on the Atlanta Police Foundations’ Board of Trustees, giving ample reason to believe that their efforts to fund state-sanctioned violence against Black Americans isn’t stopping anytime soon.

In addition, Wells Fargo has consistently shown that it has no reservations about targeting its Black patrons with predatory schemes. Their discriminatory practices against Black homebuyers have failed to shift, prompting the city government of New York City to divest from opening any new accounts with Wells Fargo in April 2022. This is noteworthy given that in the midst of the wave of racial reckoning that swept the nation in the summer of 2020, Wells Fargo CEO and President Charlie W. Scharf issued 5 major commitments in the realms of representation, compensation, diversity role reporting, education session and anti-racism manager training. From doubling black leadership, to establishing positions to drive diversity and inclusion, it seemed to be an ambitious plan. But with Wells Fargo still facing discrimintation lawsuits and government divestments in 2021 and 2022, these statements have proved to be nothing more than an attempt to save face in the eyes of the public. It is worth noting that the pledges from Scharf and Wells Fargo were made on already shaky grounds; Scharf chalked up the scarcity of Black employees at the company to “a very limited pool of Black talent to recruit from” in a virtual meeting, followed by a June 2020 company-wide memo. This statement drew criticism from U.S. Congresswoman Alexandria Ocasio-Cortez and NAACP Legal Defense and Educational Fund President Sherrilyn Ifill, among others, but more importantly, it drew attention to Wells Fargo’s dismal record in the Black community.

The superficial nature of Wells Fargo’s PR response was revealed early last year when they asked shareholders to vote no on racial equity resolutions: “In recent days, they [Wells Fargo, Bank of America, Citigroup Inc., Goldman Sachs Group Inc., JP Morgan Chase] have all officially opposed shareholder groups’ calls for them to conduct and publicize racial-equity audits and other changes, saying they are already doing enough to address equity issues” . Wells Fargo’s actions as of late, with its relationship with the Black community hanging on a tightrope, have only exacerbated the problem. A lawsuit filed on March 18 in a San Francisco federal court, argues that Wells Fargo’s practices push Black homeowners into foreclosure, which Bloomberg referred to as a modern form of redlining. Bloomberg published an article only a week earlier detailing how Wells Fargo, the largest bank mortgage lender in the country, accepted less than half of Black mortgage refinancing applicants in 2020. Seventy-two percent of White refinancing applicants were approved, compared to just forty-seven percent of Black applicants, per Bloomberg’s analysis and as visualized below. Most recently, Wells Fargo was accused of conducting “fake interviews” of diverse candidates for positions that were already filled, in a bid to boost diversity efforts on paper. Wells Fargo’s overtly discriminatory practices are a blatant indication that its claims of having a “watershed moment” during the height of Black Lives Matter protests was a lie. Simply put, since its acquisition of Wachovia, Wells Fargo continues to utilize its financial power to uphold the institutions that directly threaten the wellbeing of Black Americans, in a bid to prioritize its own financial gain.

Given all their wrongdoings, the only option is for Wells Fargo to use their billions of dollars to make restitution to all the Black people they exploited to become the financial powerhouse they are and all the Black lives they continue to profit off of to maintain their standing. There are incredible organizers applying pressure for Wells Fargo to resolve their past grievances and others who work on helping the average consumer find alternative banking methods.

But while Wells Fargo paying reparations will help mitigate some of the harm done, the systems that allowed these actions to unfold must also change. Systemic harms also require systemic solutions, which is why Corporate Accountability supports H.R.40, the congressional bill to develop and implement a comprehensive study focused on “the effects of slavery…and recommend appropriate remedies including reparations”. Action at the national level is necessary to repair the historic crime of kidnapping and slavery, and the ongoing exploitation of Black Americans from the forced labor of the convict leasing and prison systems, and discriminatory mortgage lending policies. Please join us and our allies at the Institute of the Black World 21st Century in supporting H.R. 40 by calling on your congressional representatives to cosponsor this bill today! You can learn more about H.R.40 on the Congress website.

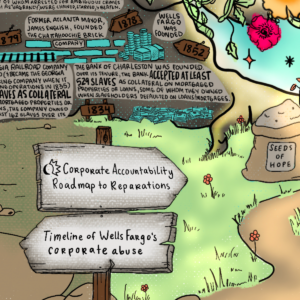

Check out a visual representation of the racist history of Wells Fargo, along with the actions organizers are taking to demand reparations, in the Roadmap to Reparations, a beautiful timeline illustrated by Paloma Rae.